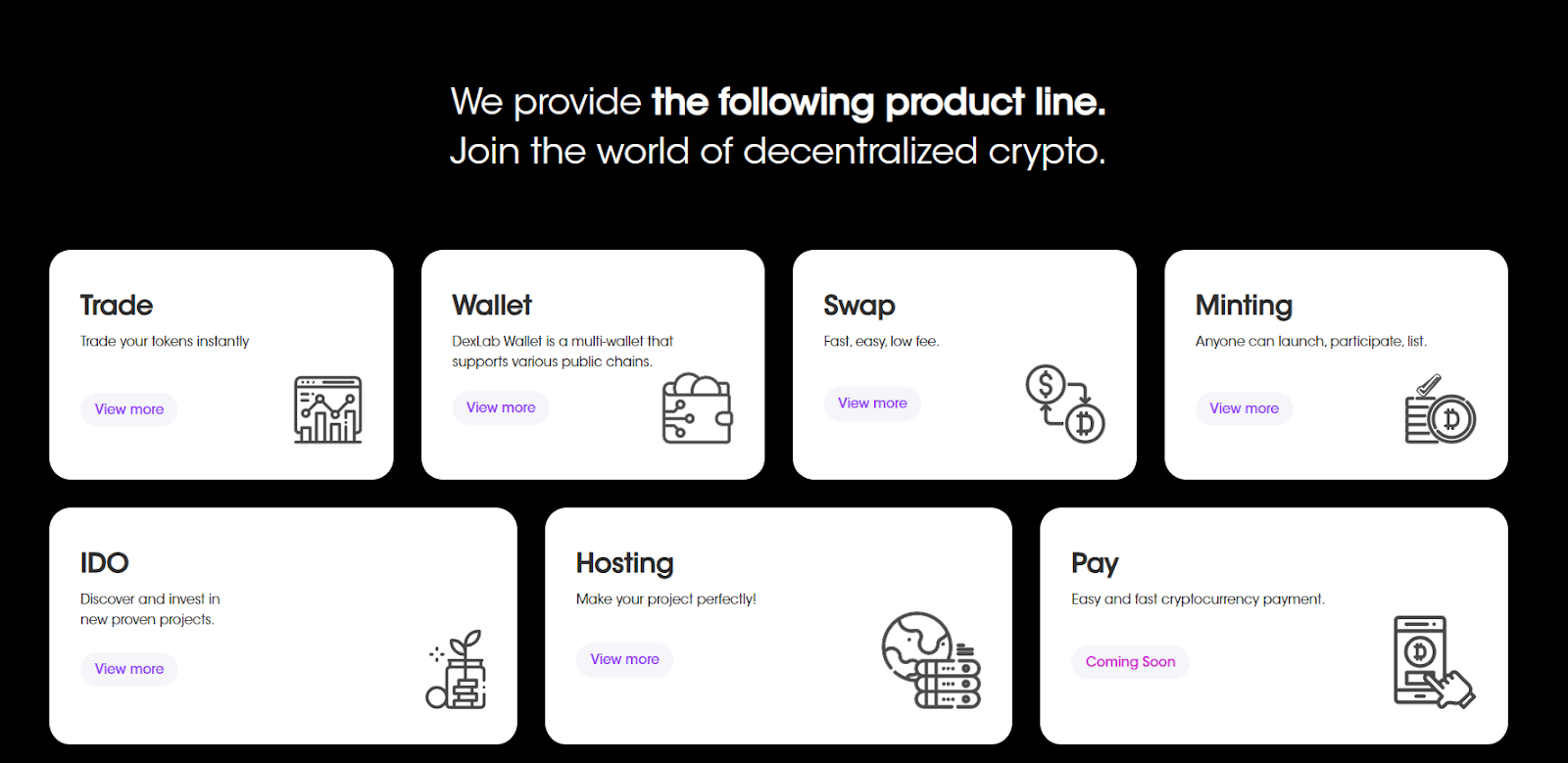

Dexlab is an innovative platform designed to improve the functionality and accessibility of decentralised finance on the Solana blockchain. Dexlab Sol, acting as a token exchange platform, allows users to effortlessly trade SPL tokens using its advanced order book system. The protocol stands out for its token creation lab integration, a launch pad for initial DEX and Web3 offerings, a platform for seamless trading and asset exchange.

The protocol has its own token, DXL, and plays a critical role in the entire Dexlab ecosystem. Some of the ways the token is used include paying transaction fees, paying for data storage, staking for validator operations, and participating in important platform decisions. This aspect of governance allows token holders to influence the allocation of network resources and the strategic direction of the platform.

In this article, let’s look at what Dexlab Solana is, the pros and cons of the platform, the features available to users, and the specifics of DXL tokenomics.

About Dexlab

Dexlab was officially launched in the summer of 2020 by founder Dennis Lee. Since their founding, they have been actively developing, creating useful tools in the Solana blockchain space. The project team continues to work on innovative solutions utilising the unique capabilities of this platform.

Solana was chosen as the main blockchain network due to its high performance: the network is capable of processing up to 50,000 transactions per second (tps), with an average fee of only about $0.00025 per transaction. This makes Solana one of the most efficient platforms among all existing blockchain protocols.

Using a centralised limit ordering system based on Solana’s infrastructure, Dexlab has created a product focused on user convenience and high efficiency across the Solana ecosystem.

Dexlab Decentralised Exchange

A Decentralised Exchange (commonly referred to as DEX) is a blockchain protocol-based platform used to trade digital assets without KYC or restrictions. Although a decentralised exchange does not require an intermediary to operate, it facilitates secure peer-to-peer trading between users.

Users can trade any digital asset on DEX, provided there is liquidity for what they want to trade. Besides Dexlab, there are other exchanges on Solana, for example, the same blockchain is used by Serum and Uniswap has opted for Ethereum.

Dexlab wallet management

Dexlab offers an interface that can be used to manage wallet tokens. Using this interface, the user can easily get the balance of their tokens and the address associated with the token.

The Dexlab wallet is a convenient tool to interact with the Solana ecosystem. It allows users to manage their assets, make transactions and interact with various decentralised applications (dApps). Here are the main aspects of managing Dexlab Wallet

Profile creation

You do not need to register an account to use Dexlab, as the exchange does not access your funds. This makes the process of using the protocol secure. To be able to trade or exchange tokens, you need to integrate your cryptocurrency wallet into the platform. To do this, you will need to click on the ‘Connect’ button in the top right corner.

By default, Dexlab recommends using one of two crypto wallets – Fantom, Solfrare, but you can use others. To open all the options, you need to click on the ‘More wallets’ button. You can choose MathWallet, Coinbase and other options.

Having chosen a suitable cryptocurrency wallet, you will need to click on its icon and go to the application on your device. Next, in your personal cabinet, confirm the addition of a wallet on Dexlab. This completes the account registration. No verification is required. In the future, you will confirm all trading operations not only in the protocol, but also in the wallet.

Trading operations on Dexlab

In the trading section on DEX, users can view a chart and get some information about the pair of assets they want to trade. With the help of the chart, the trader can observe the price trend of the given cryptocurrency. If you want to make money from trading, you must be able to read charts and draw the right conclusions from price movements. If you do not learn to understand this and make financial decisions, the risks of losing money increase.

The analytics section displays various price movements, trends and data from the Solana blockchain network in a user-friendly form. Compared to other Solana analytics platforms, Dexlab is not the best, but the data found on the dashboard is useful nonetheless. You can select a market from a list of tokens on Dexlab (which also means the token whose price change you want to study).

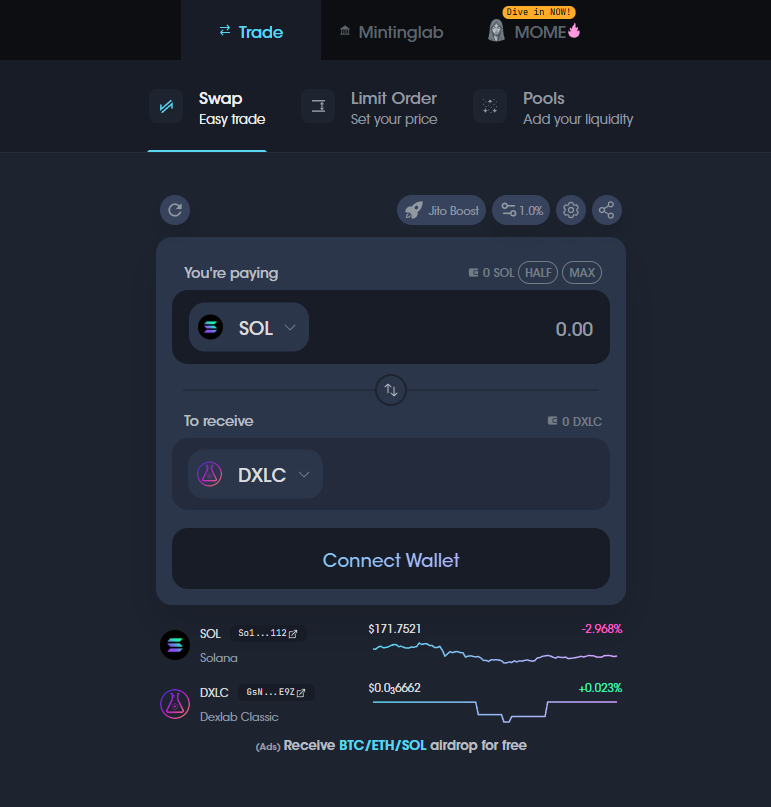

In addition to trading on Dexlab, customers can also swap tokens. The Dexlab Swap process is less complicated and risky than asset trading. In this section, the exchange has three functionalities that customers can take advantage of.

The first one is token exchange. You only need to specify in a special form which token you are giving and what you want to receive. In order for the exchange rate to be the most favourable, you should set the slippage percentage. It determines how much the real conversion rate may differ from the one shown in the application. After entering the number of tokens to exchange, you can open the price information, where the cost of the commission will be indicated.

The second is buying through a limit order. A limit order in cryptocurrency is an order to buy or sell cryptocurrency at a specific or more favourable price. Unlike market orders, limit orders allow you to specify the exact price to buy or sell a cryptocurrency. Once the order is left, it retains its status until the trader decides to execute or withdraw it.

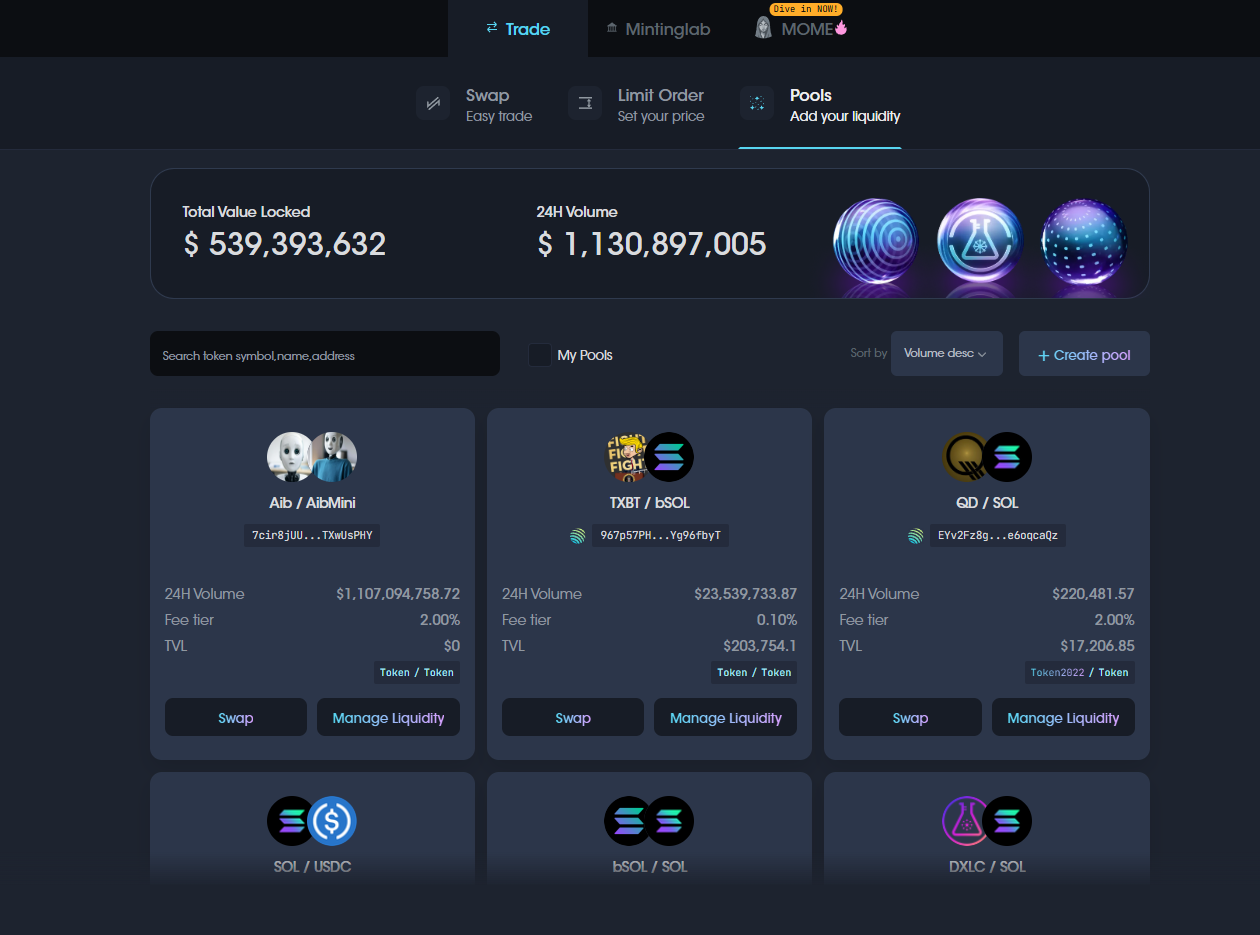

The third is adding their assets to liquidity pools. Users receive some income for providing liquidity. You can create your own liquidity pool or choose an existing one. Pools are used for instant exchange of crypto assets without the involvement of intermediaries. Users who add their cryptocurrencies to the pool are called liquidity providers. In exchange for their contribution, they earn a portion of the commissions from transactions that pass through the pool and sometimes receive special tokens – LP tokens.

Mining Lab

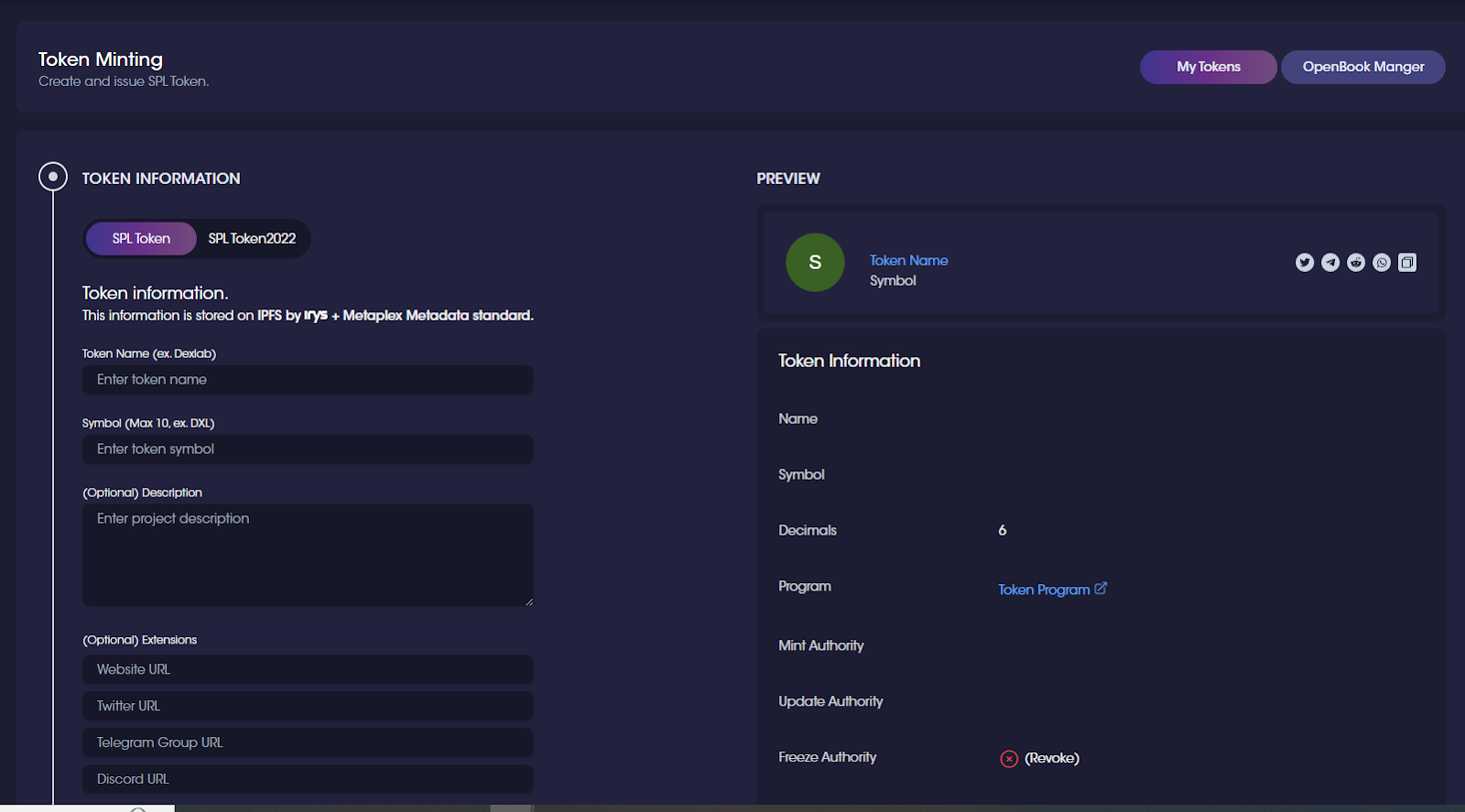

We’ve already mentioned that DexLab offers an easy way to create Solana SPL tokens. Usually, the token is created and managed in the Solana blockchain using the command line interface (CLI). But this tool is actually not very user-friendly.

With a modern GUI and intuitive design, the Solana token mining platform has made the process of creating your own tokens easier than ever. Now it’s available to everyone, even those who have no programming knowledge.

To create your own token, you will need to go to the Mintinglab section and then follow the system’s prompts. Among the actions that will be required of you can be highlighted:

- give a name and symbol to the token;

- a description is not necessary;

- upload an image and then wait for approval in your wallet’s pop-up window;

- The symbol image URL will be automatically populated once the image is uploaded.

- Click ‘Upload IRYS metadata’ and verify approval of the wallet transaction.

Mintinglab’s default setting does not freeze authority. Freezing credentials means not managing tokens. Adding and burning cannot be performed if you freeze the credentials.

When issuing tokens, you can distribute them to multiple wallets. The specified amount for each wallet address will be issued, and any remaining tokens will be sent to the token centre wallet. This amount includes a transaction fee. Simply enter the wallet address and specify next to it the number of tokens you want to distribute. The distribution of tokens by the authority will be adjusted accordingly.

All you need now are a few ideas, either original or based on other projects such as NFT (non-fungible tokens) that already exist in this ecosystem. And with DexLab’s tools, creating new smart contracts becomes a breeze, as all customisation can be done remotely, without having a line of credit or worrying about transactions getting stuck during crowdsale periods.

Since the launch of Minting Lab, over 1,000 tokens have been issued through the platform. In addition to the capabilities provided by the token minting lab, the software under development also includes the ability to easily implement smart contracts.

DEX Initial Public Offering (IDO)

The Initial DEX Offering (IDO) platform is a mechanism for issuing new cryptocurrency tokens and providing liquidity to projects under development. The process is similar to crowdfunding: users contribute their assets (e.g. SOL or USDC) in exchange for project tokens in proportion to the amount contributed. Dexlab’s IDO platform opens access to investment in promising projects for a wide audience, whereas previously this opportunity was available only to venture capital funds.

Projects that use Minting Lab to create their tokens can then raise funding through a public offering on the IDO platform. This is a simplified way to register a project and engage the community in trading the new token. Examples of successful launches on the Dexlab platform include Sypool Standard and Blocto Standard.

How Dexlab is secured

Security and safety of funds is one of the most important things that DeFi project users care about. Let’s take a look at how the Dexlab protocol ensures security. The platform takes a multi-faceted approach to security, integrating both technology and strategic partnerships to secure user data and assets.

The platform uses Secure Fetch, Private Share and Advanced Security features that are designed to protect against unauthorised access and data breaches. These security measures are further enhanced by the use of military-grade encryption and blockchain technology, providing strong protection against potential cyber threats.

Dexlab’s partnerships with organisations such as Phi Alpha Delta Delta Law Fraternity and Clio demonstrate the company’s commitment to maintaining high security standards. These alliances strengthen the platform’s defences and help develop best practices for data protection in the cryptocurrency industry.

Based on the Solana blockchain, Dexlab’s platform benefits from additional security advantages. Solana is known for its high throughput and low fees, as well as its unique security features, including decentralised consensus mechanisms and reduced vulnerability points compared to centralised systems.

The platform token, DXL, plays a central role in the ecosystem, providing transaction payment, validator node staking and voting management. This integration of DXL strengthens the relationship between user interests and network security.

Dexlab’s security strategy is comprehensive, incorporating advanced technologies, strategic partnerships and the innate advantages of blockchain technology to protect user data and assets. This approach positions Dexlab as a secure platform in the cryptocurrency industry, giving users peace of mind when interacting with its decentralised exchange and tokenisation services.

Dexlab Tokenisation

Dexlab Crypto issued its DXL token on 31 July 2021. The tokenisation of the Dexlab token is as follows:

- total offering size – 1,000,000,000,000;

- initial price – USD 0.02

- capitalisation at the time of the review’s release – $34,400.

DXL is available for trading on the Dexlab trading platform.

The total token volume is distributed among platform owners, investors and coin holders. DXL token distribution scheme:

- mining and remuneration pool – 19.5%;

- marketing and community – 15%;

- development incentives – 15%;

- ecosystem reserve – 15%;

- team – 10%;

- liquidity fund – 10%;

- strategic reserve – 5.5%;

- advisory – 4%;

- seed – 4%;

- IDO round – 2%.

Due to low demand, it is difficult to buy DXL tokens on DEX and CEX exchanges. They are not listed on most of them.

What key developments have taken place for Dexlab

Dexlab continues its active development. There have been several significant events during its formative stages that have made the protocol one of the best to work with the Solana blockchain. The platform played a key role in the launch of tokens on Solana, offering a suite of tools and services designed to simplify the process for developers. This includes a token creation lab, a DEX initial offering platform (IDO) and a dedicated decentralised exchange (DEX) for asset trading. These tools not only support the growth and development of the Solana ecosystem, but also increase the accessibility and efficiency of blockchain technology to a wider audience.

The platform has influenced not only the technical aspect, but also the attitude towards the crypto market. The project team has been actively involved in industry events. This includes hosting educational events focused on data security, sponsoring sessions at legal and technical conferences, and participating in various forums. These actions underscore Dexlab’s commitment to not only promoting its platform, but also contributing to the broader discourse on blockchain technology and its applications.

Among other things, Dexlab has signed important service agreements and intellectual property licences, confirming its position as one of the leading players in the blockchain industry. The platform’s involvement in clinical trials and partnered drug discount programmes underline its potential for influence far beyond the blockchain sphere, spanning industries such as healthcare and law.

Dexlab’s native utility token, DXL, is central to the ecosystem, supporting transactions, staking for the operation of validator nodes and system management. DXL’s total supply is 1 billion tokens, distributed in such a way as to support the operation of the mining pool and rewards, support marketing, incentivise development and other key areas to ensure the balanced development and sustainability of the ecosystem.

Dexlab continues to build and strengthen its governance and expand its services, while remaining a key element in the Solana ecosystem, driving innovation and accessibility of blockchain technology.

Conclusion

The Dexlab protocol is a powerful decentralised finance (DeFi) solution that provides security, transparency and scalability. Based on the Solana blockchain, Dexlab offers a wide range of possibilities for developers and users looking to create innovative financial products. The protocol’s unique features such as high performance, low fees and inbuilt security make it an attractive choice for cryptocurrency market participants. By working closely with renowned organisations and integrating the DXL native token, Dexlab aims to set new standards in DeFi and digital assets.

Answers to Frequent Questions

What is Dexlab Solana?

SolanaDexlab is a DEX, that is, a platform that allows token exchange. It also has a set of tools to handle all aspects of SPL tokenisation, including its own launchpad. It also has its own token called DXL.

What advantages does Dexlab offer?

Dexlab offers fast transaction processing speeds, low fees, high security by utilising the Solana blockchain and integration with the native DXL token, which increases the flexibility and resilience of the system.

What blockchain is used in Dexlab?

Dexlab is built on the Solana blockchain, known for its high transaction processing speed and low cost.

What is the role of the DXL token in the Dexlab ecosystem?

The DXL token is used to pay transaction fees, participate in staking, and manage the network through voting. It is a key element of the ecosystem, linking user interests and maintaining network security.

What organisations are partnering with Dexlab?

Dexlab has partnered with organisations such as Phi Alpha Delta Delta Law Fraternity and Clio to help improve security and develop best practices for data protection in the cryptocurrency industry.

What types of financial transactions does Dexlab support?

Dexlab supports a variety of financial transactions, including digital asset creation and management, trade transactions, staking, and protocol management voting.