In 2024, Meme coins took the leading position among the fastest growing assets in the crypto market. Their total market capitalisation reached $62 billion, with daily trading volumes exceeding $10 billion, according to Coingecko data for the month of February.

This trend has been so powerful that over 1.36 million different tokens were issued on the Solana platform alone over the past year, according to data from analytics service Dune. However, despite such rapid development, experts warn that memecoins are often among the first candidates for extinction. Most such projects start without any productive idea, which makes them vulnerable to a rapid decline in investor interest.

This phenomenon attracts the attention of millions of new market participants, but in parallel creates significant threats to the long-term development of the cryptocurrency industry. Let’s talk about the reasons for the popularity and risks associated with meme crypto token.

What are Memecoins

Memecoins are cryptocurrencies based on popular internet memes. Unlike traditional cryptocurrencies such as bitcoin, memecoins are initially developed more as a joke than as a serious financial vehicle. They exist solely in digital form and have no physical analogue.

The main differences between memecoins and other cryptocurrencies:

- Purposes of creation. Memcoins appear mainly for entertainment, whereas traditional cryptocurrencies such as bitcoin were created to solve specific economic problems (e.g. decentralisation of financial transactions).

- Factors of price growth. The value of memecoins is highly dependent on the popularity of the meme underlying them and the general level of hype surrounding the project. While the price of conventional cryptocurrencies grows due to practical application in real projects and technologies.

- Audience. Most often memecoins are bought by ordinary users who are fascinated by meme culture and seek to participate in the entertainment process. Whereas traditional cryptocurrency attracts the attention of large companies and financial institutions.

Many memecoins have been named after famous personalities or cultural phenomena. For example:

- FLOKI is named after Ilon Musk’s dog,

- MAGA is inspired by Donald Trump’s election campaign.

Also popular are coins based on iconic internet images, such as:

- DOGE, linked to a dog of the Shiba Inu breed,

- PEPE, based on the famous Pepe the frog meme.

Memecoins and altcoins should not be confused. While memecoins are sometimes categorised as altcoins (any cryptocurrency other than bitcoin), it is important to understand that these terms are not interchangeable. Altcoins represent a wide range of digital assets, many of which have serious technological underpinnings and commercial applications. Memcoins, on the other hand, stand out for their playful nature and reliance on meme virality.

Investing in memecoins is often perceived as a gamble. These assets are subject to sharp price fluctuations as their value is largely determined by public interest and the attention of influencers. An example of this effect is the case of Dogecoin, where a single social media post by Ilon Musk led to a sharp rise in the value of this cryptocurrency.

Characteristics of meme coins

As you dive into the world of meme cryptocurrency, you quickly discover a few key features that set them apart from other cryptocurrencies. One of the main traits is their high level of supply, which ensures low and affordable prices. This oversupply itself becomes part of their appeal, allowing anyone willing to purchase their shares without significant cost. Massiveness and affordability reinforce the playful atmosphere inherent in memes.

Community is a key success factor. Meme coins depend heavily on their community, which actively participates in their development and promotion. Unlike traditional cryptocurrencies with clearly defined developers and plans, memecoins develop from the bottom up, reacting to social media trends and viral campaigns. It is community activity that determines the fate of memecoins: it can either lift them to the top or cause them to crash. This factor makes memecoins extremely volatile, as their value is directly linked to the interests of the public.

Lack of practical value. Most memecoins have no meaningful functional use. Their value is formed mainly on the basis of the noise and hype created around them. This is in stark contrast to traditional cryptocurrencies, which are task-focused and offer real benefits. The volatility of memecoins makes them incredibly unpredictable: prices can skyrocket or crash in just a matter of hours, following changes in social media sentiment.

Game Branding. The name and visuals of memecoins reflect their jokey origins. The bright and unusual style appeals to a wide audience, including those new to the world of cryptocurrencies. The light-hearted nature of coins makes them accessible and understandable to everyone, but it also opens up opportunities for manipulation and misinformation, as the outward merriment can hide significant risks.

Differences between memecoins and traditional cryptocurrencies

Memecoins differ significantly from traditional cryptocurrencies in a number of important ways:

- A focus on culture and community engagement. Where traditional cryptocurrencies seek to solve specific problems and offer technical innovations, memecoins are based on the cultural component and activism of their followers. Meme coins often emphasise marketing and social media presence rather than technical progress or planning for the future.

- Dependence on hype. While traditional cryptocurrencies tie their value to real-world usefulness and applicability, memecoins are based on the level of hype and community interest. Social media plays a critical role in shaping the value of memecoins, making them extremely sensitive to short-term trends.

- Less formalised governance. Traditional cryptocurrencies are usually managed by professional teams with clear strategies and roadmaps. Memcoins, on the other hand, often develop spontaneously without centralised guidance, which adds an element of unpredictability to their future.

- Trend-related volatility. The price of memecoins fluctuates according to social media trends, while the value of traditional cryptocurrencies is usually determined by their functionality and technological base. This dependency makes memecoins both exciting and risky: their value can skyrocket or fall following the trends of public opinion.

These differences emphasise the uniqueness of memecoins as a phenomenon that combines the financial sphere with elements of pop culture and entertainment.

Why are meme cryptocurrencies so popular?

The bitcoin meme coin has logical reasons for its popularity, which add up to the general advantages of this type of asset. Let’s list the main reasons that have made memecoins a trend in the cryptocurrency market.

Simplicity

Memecoins attract ordinary internet users rather than professional crypto specialists. This makes them accessible to a wide audience. You don’t need a deep knowledge of economics or technology to work with them – all you need is excitement and a desire to try something new. The process of buying memecoins is simple and intuitive, which creates the feeling of a game: you see it, buy it, and wait for the result. Creating new memecoins is also relatively easy, so they appear constantly, keeping the audience interested.

Internet culture

You have to learn about serious cryptocurrencies through specialised sources, whereas information about memecoins spreads virally – through memes, posts on social networks and community discussions. The popularity of memecoins on the Internet forms an active community of fans, who themselves participate in the promotion of their favourite coins.

Entertainment

Investing in memecoins has become a new kind of leisure. People have already got used to enjoying videos, games and social networks, and now add to this list earning money on memes. The possibility of combining pleasure with utility – earning income while doing something that makes people smile – makes memecoins even more attractive.

This approach makes memecoins popular among a wide audience, offering a simple and fun way to interact with cryptocurrencies.

How to make money with meme coins: a selection of tips

Meme coins list includes hundreds of coins, and their total capitalisation exceeds $62 billion. Such a large market can’t be ignored, so we’ll share five tips to help you navigate the meme coins list.

Research social media

The first thing to do is to familiarise yourself with the project’s discussion on social media, especially Twitter. An active project account and positive reviews are good signals. A missing official profile or criticism of the project should raise suspicion.

Use supporting tools

Tools like DEX Screener and DEXTools can help you analyse the distribution of tokens among token holders. A high percentage of tokens held in founder wallets can indicate potential risks.

Try a token sniping strategy

Sniping involves quickly buying tokens as soon as liquidity is added. This allows you to earn hundreds of per cent profit in a short time. Useful Telegram bots such as BONKbot, SolTradingBot and Unibot simplify this process by helping you keep track of new token pools.

Learn from the experience of others

Use successful strategies from top traders. Tools like AlphaTrace show you which approaches are most profitable. Pay attention to wallets with a high percentage of successful trades ($500-600k+) and a positive balance (PnL).

Don’t forget about security

Concentrate on trusted projects and use services like RugCheck to assess fraud risks. Be careful with new projects to avoid losses.

Following these recommendations will help minimise risks and increase the chances of a successful investment in memecoins.

Prospects for meme coins in the cryptocurrency market

With internet culture and cryptocurrencies closely intertwined, memecoins may continue to strengthen their position. The constant emergence of new coins aims to capitalise on current viral trends, highlighting their flexibility and ability to adapt to the rapidly changing digital landscape. Thanks to their connection to the community, memecoins remain relevant and have the potential for further growth.

However, the long-term prospects for memecoins remain unclear due to their speculative nature. While they can generate high short-term returns, they often lack the technological foundation and utilitarian value of traditional cryptocurrencies. This makes them vulnerable to market bubbles, where rapid growth is followed by a sharp decline, exposing investors to significant risks.

Recognition of memecoins by major platforms could elevate their status and integrate them into the mainstream cryptocurrency market. As platforms expand their support, memecoins can attract a wider audience, increasing their credibility. This recognition has the potential to transform memecoins from a niche asset to full-fledged market participants.

Along with the growing popularity of memecoins, the likelihood of regulatory intervention increases. Governments and financial institutions will start to pay more attention to their influence, which will lead to tighter controls. Despite the potential challenges, this regulation may help create more stable and responsible memecoin projects.

Income potential and benefits of investing in memecoins

Despite the risks involved, memecoins have the potential for significant short-term gains due to rapid price growth. Those who invest in successful memecoins in time can expect impressive returns, as the initial excitement and community support can drive the price to record levels. This quick money-making potential attracts investors willing to embrace the volatility and uncertainty that characterises memecoins.

Community-driven projects can offer unique rewards and incentives to participants, encouraging engagement and collaboration. Memcoins often utilise their social base to create value by offering perks such as exclusive offers, promotions or rewards for being active. This creates a sense of belonging and purpose, turning memecoins into more than just financial assets.

By strategically investing in memecoins, you can diversify your cryptocurrency portfolio, gaining exposure to different market dynamics and trends. Adding memecoins to an investment portfolio helps to balance risk and take advantage of the unique opportunities offered by these digital assets. However, such investments should be approached with caution and should only be considered as part of a broader strategy.

Memcoins allow for engagement with active and creative online communities, providing a sense of community and shared goals. These communities often determine the success of memecoins, and participating in them can be a rewarding experience. Connecting with like-minded people gives you the opportunity to better understand market trends, share knowledge and contribute to the development of your favourite memecoins.

Top 3 promising memecoins in 2025

Against the backdrop of the growing popularity of alternative coins, analysts have highlighted three memecoins that could be successful long-term investments in 2025.

Goatseus Maximus

This project stands out for its unusual name and mythological overtones. Launched as a joke, Goatseus Maximus shows great potential thanks to the active support of the community. The combination of mythology and meme culture has resonated with many users, allowing the project to gain a significant number of supporters.

With a unique approach to governance and tokenomics, as well as continued community support, Goatseus Maximus could become one of the biggest successes in the memecoin market in the coming years.

Cat in a Dog’s World

The Cat in a Dog’s World project appeals to animal lovers and meme fans. Its ironic message and symbolism – a cat trying to conquer the dog’s world – resonated with a wide range of users. Behind the humour, the development team is working hard to build a vibrant community and create an ecosystem with a reward system that has real financial value.

The unusual name and unconventional approach make this memecoin one of the main contenders for the leadership position in 2025.

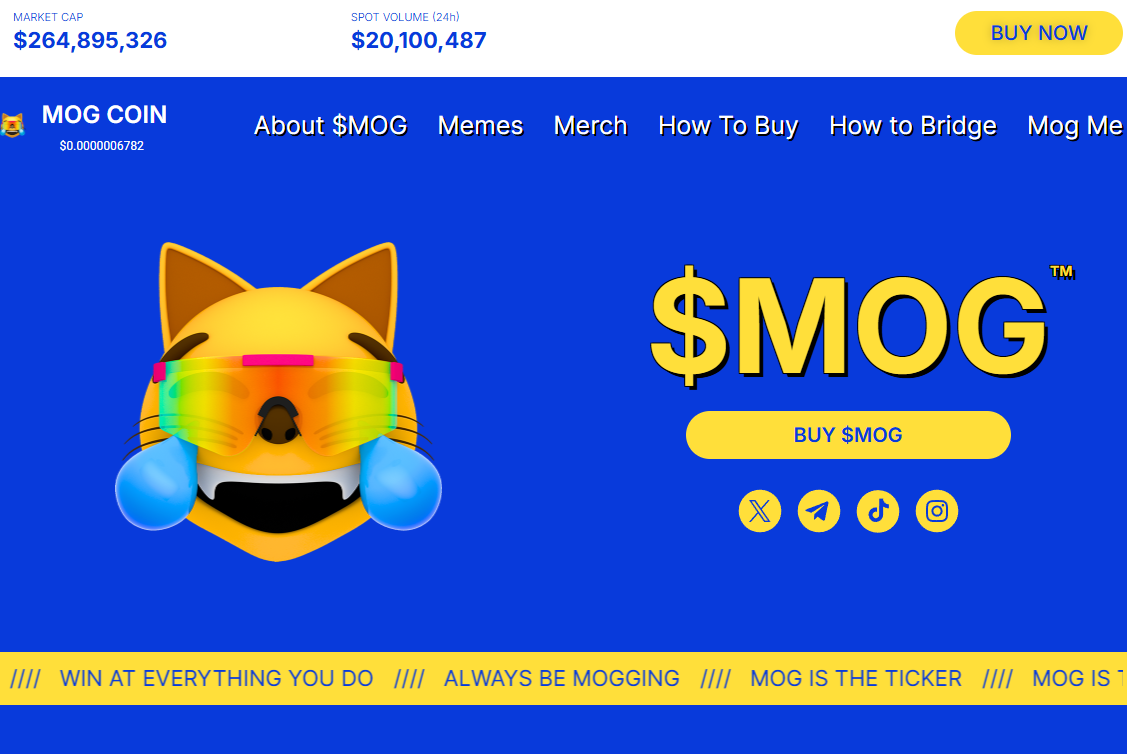

Mog Coin

Mog Coin has established itself as a memecoin targeting the younger generation and those looking for lucrative material prospects. The project is characterised by a modern concept and a strong brand, making it attractive to traders looking for breakthrough digital assets.

Thanks to a successful brand building strategy and the formation of a digital ecosystem, Mog Coin is able to occupy an important place in the market, becoming one of the key platforms for interaction between cryptocurrency owners.

These memecoins demonstrate a diversity of approaches and ideas that can ensure their success in the future.

Conclusion

Memecoins have brought a unique element to the world of cryptocurrencies and blockchain – combining collectible value, social interaction, experimental financial activity and an entertainment aspect. However, it is important to consider that investing in memecoins involves high risks and their value can vary significantly, which is ideal for margin trading. Despite this, memecoins continue to gain attention and attract more new entrants to the industry, enriching it and pushing the boundaries of what is possible.

Answering the questions

What are memecoins and why have they become so popular?

Memecoins are cryptocurrencies based on popular internet memes. Their popularity is due to their ease of understanding, low threshold of entry, and strong community support. They attract both beginners and experienced investors who want to try something new and unusual.

How are memecoins different from traditional cryptocurrencies?

Unlike traditional cryptocurrencies such as bitcoin, memecoins are often created without a specific purpose or technical justification. Their value is based on viral marketing, social media and community enthusiasm rather than actual technological innovation.

What factors are influencing the growing popularity of memecoins?

The popularity of memecoins depends on several factors: social media activity, influence of Influencers, mass culture and viral trends. Investors often choose memecoins for fun and a quick buck rather than a long-term investment.

What are the risks associated with investing in memecoins?

The main risks include high price volatility, lack of real-world application, and possible fraud. Memecoin prices can rise or fall dramatically due to news, rumours or the actions of major players.

Can memecoins become a long-term investment asset?

At the moment, memecoins are seen as speculative assets rather than long-term investments. Their success depends on maintaining community interest and viral effect, which is difficult to predict in the long term.