deBridge is an advanced interoperability layer for Web3 designed to enable decentralised transfer of arbitrary data, assets and messages between different blockchain ecosystems. Unlike many interoperability solutions that rely on centralised intermediaries, deBridge uses a network of independent validators to provide secure and near-instantaneous cross-chain transactions.

The project began operations in 2021. The project demonstrated its first cross-platform trading capabilities using Chainlink oracles as a bridging mechanism to accurately commit and unlock assets between blockchains. This was demonstrated in a proof of concept between Ethereum and Binance Smart Chain (BSC). Over time, the functionality of the deBridge exchange has expanded both in terms of combining different blockchain protocols and third-party services, including issuing its own token.

deBridge protocol overview

deBridge was founded by programmer Alex Smirnov and his assistants. Smirnov’s team was tasked with simplifying the approach to crosschain interactions. They developed their product in 2021 and with it won first place at the Chainlink global hackathon. There were 140 different entries in total, but deBridge attracted the most attention.

After winning, Smirnov company raised over $5 million to launch the project. One of the main backers was PapaFi Capital, as well as venture funds Animoca Brands, OP Crypto. deBridge received not only finance, but also management experience, which allowed it to quickly enter the market and provide services to clients.

deBridge is a cross-network communication and liquidity transfer protocol that enables the decentralised transfer of derived data and assets between different blockchains. Cross-network transactions are validated by a network of independent validators that are elected by the deBridge team. The validators maintain the blockchain infrastructure and sign all transactions that pass through deBridge’s smart contracts.

The portal attracts transaction partners with the opportunity to earn money. The validators take a percentage of the commission paid by those who transfer assets.

How deBridge works

deBridge сrypto works like a bridge that connects different blockchains. Here’s how assets are transferred from one network to another:

- Smart contracts. The protocol places smart contracts on each blockchain it supports. This allows assets to be transferred both inside and outside the network.

- Transaction Request. When a user decides to make a cross-chain transfer, deBridge smart contracts receive a request to do so.

- Oracles. After receiving the request, decentralised oracles verify the details of the transaction. This ensures that the asset exists on the source chain and is reserved for the transfer.

- Validators. The verified cross-chain request is passed to a network of independent validators. They re-validate the transaction and reach agreement on the correctness of the asset transfer.

- Transaction Execution. Once the validators reach consensus, the transaction data is transmitted to the smart contract, resulting in the actual transfer of assets from one network to another.

When five consecutive steps are completed, the customer’s funds become available in the target ecosystem.

deBridge cross-chain functionality

deBridge finance provides clients with a complete set of crosschain functionalities for efficient, secure and fast interoperability between different ecosystems. Three products – dePort, deBridge Liquidity Network (DLN) and deBridge Widget – form the backbone of the protocol infrastructure.

DePort

This custodial solution allows tokens to be placed on any supported blockchain network as illiquid, wrapped assets. This allows crypto projects to use DePort to host their assets on different networks, increasing the prospects for a successful launch and more interest from users.

DePort emphasises wrapped assets that are securely blocked in the source network while simultaneously becoming available in the destination network. This approach provides a secure method of asset transfer. It allows projects to maintain liquidity and users to safely store assets.

deBridge Liquidity Network (DLN)

DLN is used to exchange assets between networks for cross-chain trading with zero slippage without reliance on liquidity pools. By eliminating the need for liquidity pools DLN ensures that liquidity is not blocked or at risk, contributing to a more efficient and flexible ecosystem.

Users can trade seamlessly without compromising security. It is the ideal solution for fast, scalable and secure cross-chain transactions.

deBridge Widget

The feature offers developers a plug-and-play solution to embed crosschain exchanges into their applications, be it mobile apps, websites or decentralised applications (dApps). It’s a customisable option, as crypto owners can change the design, colour schemes and other parameters, tweaking their brand aesthetics.

deBridge Widget aims to simplify the integration of crosschain functionality. Through simple setup and quick integration, the service can be used to extend the functionality of networks for crosschain exchange.

How deBridge can be used

deBridge has a wide range of capabilities, which opens up prospects for use by various DeFi and Web3 applications and projects. The most common uses of the protocol are to:

- Creating your own custom bridges for assets and NFTs;

- Creating the ability for users from other blockchain systems to interact with their protocol;

- Gaining the ability to make their protocol compatible with protocols from other ecosystems;

- Creating new types of internetworking applications.

Let’s take a closer look at some of the protocol’s capabilities. Let’s talk about how inter-network data transfer works. This is the main feature of the protocol that makes deBridge unique. This is because it is not just a bridge linking two different ecosystems. In deBridge, users can transfer not only assets but also arbitrary messages between networks. Having this capability allows for a unified structure for smart contracts to work, despite being in different blockchain ecosystems. The protocol can be used for:

- deBridge swap;

- Multichain management;

- Cross-network lending;

- Cross-network pharming.

Now there is no need to find specific bridges for each blockchain. deBridge enables a single interface to work across different ecosystems.

deBridge protocol structure

The deBridge protocol works through a well-defined two-tier architecture. This ensures efficient and secure communication between different blockchains.

The first layer of the protocol. This layer includes the smart contracts within the blockchain that are deployed in each blockchain supported by deBridge. Smart contracts have several tasks. They manage assets, route interchain transfers, verify validators’ signatures and establish consensus between them. A transaction is considered secure and ready for execution only if it has collected the minimum specified number of validator signatures. If there are not enough, the transaction is rejected due to insecurity. deBridge management controls the level of admission and key parameters, including the commission rate, list of supported networks, payout ratios and validator lists.

The second layer of the protocol is responsible for the platform infrastructure. This part of deBridge’s operation consists of a network of trusted validators that manage individual deBridge nodes within designated blockchain networks. Validators play a critical role in carrying out all of the project’s work, as they sign all transactions that pass through the deBridge protocol. The rate delegation and reduction mechanics enhance the security of the protocol and prevent validators from colluding.

Using these two layers, the platform provides customers with a secure and decentralised platform for inter-network transfers. The operation of the algorithm is simple and transparent, which increases the trust in the platform.

Practical applications of deBridge

The most common use of the protocol is to move cryptocurrency from one network to another. Ethereum, BNB, Chain, Polygon, and Arbitrum are the most popular.

For each operation in the protocol, users pay a commission. It is distributed between the resource owners and validators that confirm transfers between different networks. The commission itself consists of two components – a fixed fee and a percentage.

The fixed fee is deducted in the underlying blockchain asset. For example, if a user transfers an asset from BNB, the fee will be deducted from the wallet on BNB in favour of that protocol. This approach is necessary to allow smart contracts to interoperate between different networks.

The second part of the commission is retained by deBridge. The protocol takes 0.1% from each transfer.

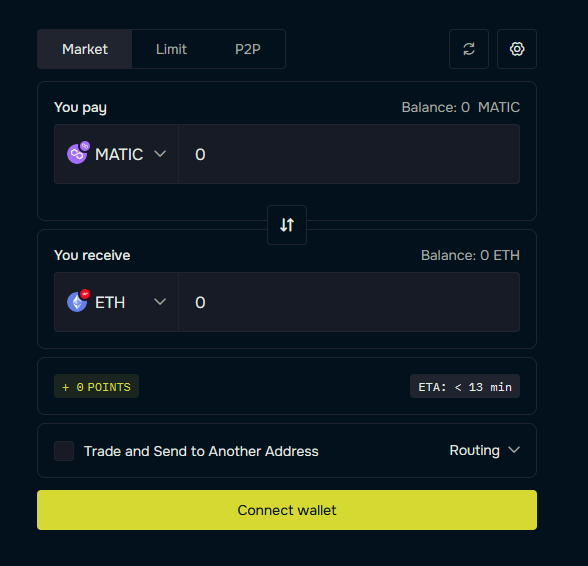

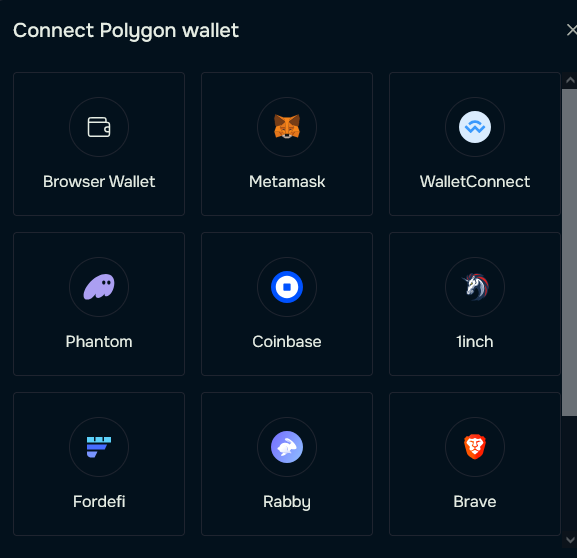

To make a transfer, a client needs to add his cryptocurrency wallet on the deBridge Finance portal. To do this, click on the ‘Add Wallet’ button and select the appropriate option from the drop-down list. The protocol supports more than 10 crypto wallets.

After adding a cryptocurrency wallet, it will be necessary to click on the ‘Go to dApp’ button. In the next step, the user adds networks. First, he specifies the basic protocol, and then those ecosystems with which he plans to interact. In order for the exchange to be successful, the balance in different networks must have enough funds to pay the commission and the transaction amount itself.

Once all networks have been added, the user must select the desired networks to be exchanged and tokens in Swapp Asset. You will need to specify the underlying blockchain under the ‘Send from’ button, and then choose the network and tokens that you want to receive under the ‘Send to’ button.

After verifying that all the data in the application form has been filled in, you will need to confirm the transfer and confirm again on the website. Then information about the operation will appear in the cryptocurrency wallet, if you use MetaMask, the exchange must be confirmed in it. If you did not make any mistakes when filling out the application, the tokens you ordered will appear on the balance of the cryptocurrency wallet.

deBridge Tokenomics

DBR is the managing token of the deBridge ecosystem with a total issuance of 10 billion tokens. It gives deBridge token holders the ability to participate in DAO management and make decisions. Here’s how deBridge’s tokens are distributed:

- 20% – community and launch, these tokens aim to support interest in the project;

- 26% – ecosystem support for full growth and development;

- 20% – reserved coins for participants and the team;

- 17% – tokens allocated for strategic partners of the protocol;

- 15% – amount of cryptocurrency allocated to the deBridge fund, which is dedicated to long-term planning and maintaining the ecosystem;

- 2% – tokens reserved for validators that ensure the security of the network.

The first deBridge Airdrop has already taken place. In the first distribution, 1.8 billion tokens were issued out of a possible 10 tokens. All airdrop recipients have the option to receive 50 per cent at the token generation event (TGE), 50 per cent after six months or 80 per cent at the token generation event minus a 20 per cent penalty.

The token is powered by the Solana protocol. Initial trading opened at $0.03 per DBR, a production valuation totalling $300 million. DBR will allow holders to vote on future strategies and implementations of the deBridge protocol. The project has tentative plans to implement stacking features in the future.

Pros and cons of the platform

Advantages:

- Versatility – supports a large number of blockchains and assets;

- Security – use of smart contracts and oracle network;

- Convenience – easy to move assets between different ecosystems.

Disadvantages:

- Integration difficulties – developers may need time and effort to integrate the protocol into their projects;

- Dependencies on oracles – the effectiveness of the protocol is directly related to the reliability of the oracle network.

Conclusion

deBridge is a powerful tool for internetworking with the DeFi sphere. The use of the protocol allows clients and developers to quickly and securely move assets and create decentralised applications running on multiple blockchains. Despite some drawbacks, such as integration complexity and reliance on oracles, deBridge remains one of the leaders in its field, offering high versatility and security.

deBridge is actively developing and the value of its own token will increase. In 2024, the platform announced the launch of a new deBridge P2P project. The new platform fully supports cross-network non-storage OTC transactions, allowing anyone to choose their own counterpart for cross-network transfer trading. This development is a major step forward for DeFi, giving users greater flexibility and control over their transactions.

Answers to common questions

What is deBridge?

deBridge is a high-performance and secure interaction layer for Web3 that facilitates decentralised transfers of arbitrary messages and values between different blockchains. deBridge acts as a bridge, allowing assets to move freely between different blockchains, opening up the possibility of token exchange without intermediaries.

What blockchain networks does the deBridge protocol support?

The list of blockchain networks between which you can make a transfer in deBridge is constantly expanding. Among the popular chains we can highlight Ethereum, Airbitrum, Avalanche, Solana, Polygon, BNB, Base.

What are the main features of the deBridge platform?

The platform is designed to exchange assets from one network to another, but there are other features that distinguish the project among decentralised platforms. With deBridge, you can track transactions in real time, as well as assess the state of the network. The platform provides information about the state and performance of the supported circuits, allowing users to assess reliability and make informed decisions.

How to use deBridge?

There are no difficulties in working with the platform. deBridge has a simple and clear interface, so even those who have not used decentralised applications before will be able to understand it. Working with the platform starts with adding your cryptocurrency wallet. After that, you can move on to transferring funds. You need to choose the chain you plan to transfer funds to and which token you need. Note that you can transfer funds to yourself or specify another address for the exchange. Having selected a pair, you need to specify the amount of the transaction. The conversion amount and the amount of commission will be calculated automatically. You will need to confirm the transaction first in deBridge and then in your cryptocurrency wallet.

How does deBridge ensure security?

deBridge uses a two-tier architecture with smart contracts on-chain and off-chain transaction verification by trusted validators, ensuring transparency, control and integrity of the network.

What are the benefits of using deBridge?

DBridge offers high liquidity, competitive spreads, guaranteed rates and a decentralised platform for secure cross-chain interactions, opening up a wide range of opportunities for developers and projects in the DeFi ecosystem.