Web3s have sparked a new round of interest in cryptocurrencies. Decentralisation, user ownership and compatibility with different types of blockchain underpin the increased interest.

The cryptocurrency market remains highly risky, but the emergence of new projects that address pressing issues are making it a more attractive investment. Attitudes around the world towards Web3 Coins are changing. In this article, we will explore the top ten Web3 crypto coins that are poised to become the most sought-after in 2025.

What are Web3 tokens?

Web3 crypto coins are digital assets that are built on blockchain technology and are set to become part of the Web 3 ecosystem. Web 3 refers to the third iteration of the internet, characterised by decentralisation, peer-to-peer interactions, and increased ownership and independent custody and control of each user’s data.

In 2015, Klaus Schwab called it part of the ‘fourth industrial revolution.’ It will see the transformation of familiar life into a digital landscape. Artificial intelligence (AI), blockchain and the Internet of Things (IoT) will play a decisive role in this.

What Web3 stands for

Web3 is the concept of a new version of the internet that involves decentralisation, using blockchain and cryptocurrencies to create a more transparent, secure and independent network. The core principles of Web3 include:

- Decentralisation. Unlike traditional centralised platforms such as Facebook or Google, Web3 aims to create decentralised applications (dApps) that run on the blockchain. This means that data and processes are not controlled by a single organisation, but are distributed across multiple nodes.

- Blockchain. Blockchain technology is used to provide transparency and security in transactions. Blockchain allows the creation of immutable records, making it ideal for financial transactions, data management and many other applications.

- Cryptocurrencies. Cryptocurrencies such as Bitcoin and Ethereum play an important role in Web3, enabling decentralised transactions without the need for intermediaries such as banks.

- Smart contracts. Smart contracts are programmes that are automatically executed when certain conditions are met. They are used to automate processes and secure transactions.

- Interoperability. Web3 aims to create open standards and protocols that allow different applications and platforms to interact with each other, ensuring interoperability and usability.

- Privacy and security. Web3 places great emphasis on protecting user data and privacy. Decentralised applications often use encryption and other methods to ensure security.

Examples of Web3 applications include decentralised exchanges (DEX), lending and borrowing platforms, NFT marketplaces, and more. This concept continues to evolve and many believe it has the potential to change the structure of the internet and how we interact with digital services.

Ethereum (ETH)

Ethereum can be considered one of the best Web3 coins. Blockchain needs no introduction as it has been at the origin of smart contracts and decentralised applications. In the near future, ETH will remain a key player in the Web 3 space. With the Ethereum 2.0 update, which moves from Proof of Work to a consensus-based Proof of Stake model, ETH aims to improve scalability, security and resilience.

As Ethereum continues to improve its capabilities and expand its ecosystem, it remains an important coin to watch in the Web3 sphere.

Polkadot (DOT)

Polkadot stands out for its unique approach to interoperability; it allows different blockchains to communicate and exchange data seamlessly.

Factors and features influencing high platform scores:

- Parachains. This algorithm allows other blockchains to connect to its relay chain, providing scalability and security.

- Governance. DOT holders have significant governance rights, contributing to the development of the network itself.

- Security. All connected chains benefit from the security of the entire network, reducing the risks associated with smaller individual blockchains.

Dot could be among the top Web 3 coins in 2025 due to the fact that the functionality of the platform is expanding and there is a high demand for decentralised applications.

iDegen

iDEGEN is the most viral token of 2024. It raised $6.1 million in just 22 days of pre-sale. iDEGEN is an experimental AI with a knowledge base created and developed through interactions with its X account.

This project unleashed an autonomous AI agent with zero initial knowledge, no restrictions and no censorship. The main idea of the platform is to show how AI learns without the influence of human control.

Key features:

- A unique project to develop a new, community-driven AI;

- Discover what happens when AI learns from cryptography X – unfiltered;

- Tokenomics creates natural scarcity.

You have a chance to join the team and purchase tokens.

Filecoin (FIL)

Digital projects generate huge amounts of data on a daily basis, so there’s a problem with storing it. Decentralised platforms such as Filecoin aim to solve this problem. The platform encourages users to rent out unused storage capacity, creating a global decentralised network for data storage.

Filecoin’s main features and innovations:

- Decentralised storage. Unlike traditional cloud services, Filecoin offers a system where users can securely store their data without relying on centralised providers. This increases privacy and reduces the risk of censorship.

- Economic incentives. Storage providers earn FIL tokens, creating an ecosystem that provides a dynamic and efficient market for storage services.

- Interoperability. Filecoin’s integration with protocols such as IPFS (InterPlanetary File System) enhances its usability, allowing developers to build applications on top of this decentralised infrastructure.

Privacy and data ownership issues are becoming increasingly important in the digital age, Filecoin’s role in decentralised storage will be critical in 2025 and beyond.

Chainlink (LINK)

Chainlink deservedly made it to the top of the Web3 coins list, as the protocol aims to connect smart contracts with real data to create a secure and reliable data channel in DeFi.

LINK tokens are essential for paying oracle operators and incentivising accurate data. Chainlink’s adaptability makes it a cornerstone of DeFi’s innovation.

The main features of the project include:

- Blockchain connectivity to external sources;

- Chainlink’s means of payment;

- the demand for the protocol in the DeFi sphere.

This makes the cryptocurrency very interesting for investment in 2025.

Solana (SOL)

Another well-known protocol in our ranking. The platform gained great popularity due to its ability to provide high throughput and low transaction fees. These qualities position Solana as the main choice for Web3 application development.

Key benefits of the protocol:

- High Speed and Scalability. Solana’s unique Proof of History (PoH) consensus mechanism allows the blockchain to process thousands of transactions per second (TPS), making it ideal for high-demand applications.

- Ecosystem. Solana supports a wide range of dApps, including DeFi platforms and gaming applications, significantly increasing its utility.

High throughput and scalability play an important role in evaluating decentralised applications. In this regard, Solana is well positioned to consolidate its position in 2025.

Avalanche (AVAX)

Avalanche is known for its unique consensus engine that stands out for its high speed and flexibility. The platform offers customisable blockchain solutions that support a variety of use cases, making it particularly attractive to developers.

Avalanche’s key benefits:

- Subnets. Avalanche enables the creation of subnets tailored to specific requirements, including governance, compliance and economic needs of various industries.

- Instant transactions. Transactions are confirmed in seconds, improving user experience and overall system efficiency.

- Compatibility. Avalanche is compatible with other blockchain networks, including Ethereum, opening up more opportunities for asset management and trading.

With the growing demand for custom blockchain solutions, AVAX’s versatility makes it one of the leaders in Web3.

Web3Bay (3BAY)

Web3Bay (3BAY) is a decentralised platform designed for trading digital assets and NFTs in the Web3 ecosystem. The platform uses blockchain technology to provide secure, transparent and decentralised buying and selling processes.

Key features of Web3Bay include:

- Support for multiple blockchains. The platform supports multiple blockchains, allowing users to trade assets from different networks.

- Security and transparency. All transactions are recorded on the blockchain, ensuring immutability and transparency.

- NFT Marketplace. Web3Bay provides a user-friendly interface to create, buy and sell NFTs, making it attractive to artists, collectors and investors.

- Proprietary token (3BAY). The platform uses its own 3BAY token to pay commissions, participate in the management of the platform, and receive discounts on services.

Web3Bay aims to become a one-stop platform for trading digital assets and NFTs, offering users convenience, security and decentralisation.

The Graph (GRT)

The Graph allows developers to use the platform to create convenient mechanisms for querying blockchain data in decentralised applications.

Key features of the protocol:

- Subgraphs. Developers create ‘subgraphs’ which are open APIs that allow dApps to efficiently extract data from blockchains, improving speed and performance in data extraction.

- Community-Driven. The Graph fosters a strong community through continuous protocol improvement, demonstrating the growing trend of decentralised governance.

With new projects saturating the Web3 market, the need for efficient data retrieval solutions is increasing. This leads to more interest in The Graph and its GRT token.

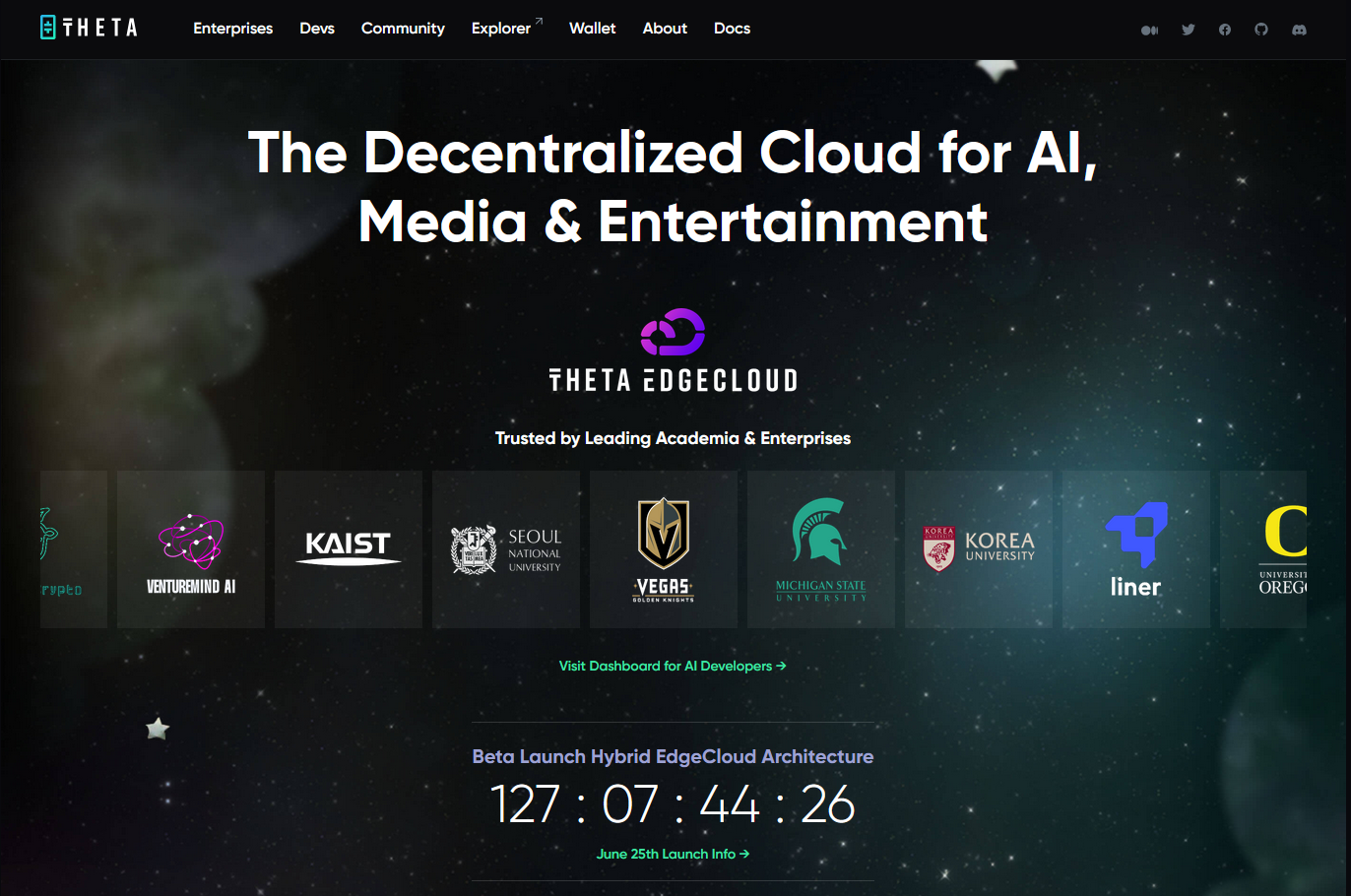

Theta Network (THETA)

The Theta Network (THETA) is a decentralised video streaming platform based on blockchain technology. The platform was created to address the problems associated with traditional centralised video streaming infrastructure such as high data costs, low bandwidth and limited scalability.

Key features of Theta Network include:

- Decentralised video streaming allows users to share excess bandwidth, earning tokens for doing so.

- Reducing costs and improving video quality, while maintaining high transmission speeds.

Streaming is becoming increasingly popular. The Theta Network service is at the forefront of this trend, making its token attractive in 2025.

How to find the best web3 crypto coins

Finding the best web3 crypto coins to invest in requires careful research and analysis. Most cryptocurrencies belong to Web3, but they are not all of the same quality and appeal. Let us tell you about the steps that will help you choose the best web3 gaming coins:

- Familiarisation. You need to learn all about Web3, decentralised applications and underlying technologies (blockchain, smart contracts, etc.), To get a deeper understanding of the Web3 landscape.

- Project Team Assessment. The experience and reputation of the team is important. Examine the makeup of the developers and investors. What experience and accomplishments do they have in blockchain and technology? Pay attention to the team’s activity on social media and forums. How they interact with the community.

- Analyse the utility of tokens. Examine how tokens are allocated. What shares are allocated to the team, investors, community. If there are clear rules for allocation and usage. Find out how tokens are issued. Is there inflation, and if so, how is it controlled? How it might affect the value of the token in the long term.

- Community and ecosystem. Assess the strength of the project’s community, developer support, partnerships, and overall ecosystem. Active communities and collaborations can indicate the project’s potential for growth and adoption.

- Market Trends Analysis. Examine current trends in the Web3 industry. What projects and technologies are attracting the attention of investors and developers, and what problems they are solving.

- Risk Assessment. Understand the risks associated with investing in cryptocurrencies, including market volatility, regulatory uncertainty, and technology risks. Research the project’s competitors. What other projects are solving similar problems.

Finding the best Web3 crypto coins requires careful analysis and research. Use these steps to make an informed choice and minimise risks. Remember that investing in cryptocurrencies always involves risks, and it’s important to do your own research before making decisions.

Is investing in Web3 profitable?

Web3 cryptocurrency has potential for the future of the World Wide Web. But before investing, it is important to understand the risks and rewards of investing.

Web3’s asset value, like any other, is influenced by supply and demand. But these are not the only factors that can have a noticeable impact on the dynamics of the value and attractiveness of Web3 coins.

- Usage. Tokens are issued by various projects aimed at solving certain problems. It is important to assess how compelling a solution the platform offers and the level of competition in this area. Projects with strong utility and real use cases tend to attract more interest and potentially see higher valuations.

- Project team and development plans. The team behind the project plays a key role. A strong team with proven experience and a clear development roadmap inspires investor confidence, which can have a positive impact on the coin’s value.

- Market condition. General market sentiment affects the entire Web3 sphere, not just individual coins. Positive news can lead to an increase in demand and therefore an increase in value and vice versa. It is important to keep an eye on news and events that may have an impact on the market.

- Total number of tokens. The price of tokens is affected by the number of tokens in circulation. Many projects introduce an artificial limit, which leads to an increase in the value of coins.

- Underlying blockchain network. The popularity and transaction rate of the blockchain network on which a Web3 project is built can also affect the price of its coin. For example, projects built on the Ethereum network may benefit from the existing user base and network effects.

- Incentivising usage. Some Web3 platforms offer reward mechanisms for using or creating tokens. This can create additional value for holders and potentially affect the price of the coin.

Conclusion

Choosing the best Web3 tokens for 2025 requires in-depth analysis and understanding of multiple factors including technological innovation, project team, tokenomics, market capitalisation and liquidity. The cryptocurrency market continues to evolve rapidly, and Web3 projects are playing an increasingly important role in this process. The decentralisation, security and transparency that these projects offer make them attractive to investors and users seeking new opportunities in the digital economy.

It is important to remember that the cryptocurrency market remains highly volatile and risky. Investors should be prepared for unpredictable price fluctuations and carefully analyse each project before investing. Portfolio diversification and doing your own research remain key elements of a successful investment approach.

The future of Web3 looks promising, and those projects that can offer innovative solutions and a sustainable ecosystem are well positioned to become leaders in 2025 and beyond. It is important to keep an eye on technology and trends to stay abreast of changes and the opportunities they bring.