Decentralised Finance (DeFi) services have scared away thousands of investors with their complex interfaces and lack of one-click interaction with DeFi protocols. However, the sector is evolving and new solutions are emerging, such as Zapper Fi, which aims to make it easier to interact with DeFi assets and interact with different ecosystems in one click.

With the Zapper service, you can track all crypto-assets on different networks through a single interface, buy cryptocurrency from a bank card, exchange tokens and transfer them from one network to another, and receive notifications. The app is free. Zapper is launched by a Canadian team, has been invested by serious investors and has attracted investment from serious funds.

What is Zapper

Zapper Fi is DeFi’s asset management service platform. It was founded in May 2020 as a result of the integration of DeFi Zap and DeFi Snap. The creators of the project are Seb Odet, Suhail Gangji and Nodar Janashia. In the year of launch, the project received about $50,000 from venture capital firm MetaCartel Ventures.

Zapper is an aggregator of projects from decentralised finance that provides a single interface to interact with DeFi projects. For example, users can use the portal to generate passive income by participating in liquidity pools on Uniswap, Curve, Balancer. The only thing the user is required to do is to connect their cryptocurrency wallet, select a liquidity pool provision protocol and transfer their assets into a smart contract.

Also on the portal you will be able to track the best offers on the Web3 investment market. The Zapper service offers customers other features such as cryptocurrency exchange, transferring assets between different networks, buying NFTs and others.

The main function of Zapper

Initially, the project was conceived as an additional tool for controlling the state of cryptocurrency assets. Now users just need to add their cryptocurrency wallet to Zapper to monitor the state of assets in real time. It is possible to easily review all transactions in one’s wallet, track assets and liabilities of other people’s DeFi by directly entering the address.

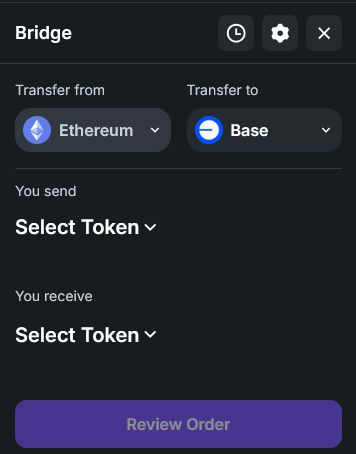

The photo below shows the personal account interface. It clearly displays all transactions, which makes working with Zapper quite simple and convenient. All information is indicated in a clear format.

In addition to the function to control your assets, other features are available on Zapper. The portal provides advanced functionality by integrating with different DeFi protocols. Customers can trade assets, create bridges between networks, sell NFTs and others.

Additional features of the protocol include tracking information on the chain. The platform supports multiple chains including Ethereum, Arbitrum, Optimism, and Polygon. Users can easily view the latest updates of projects on the blockchain, as well as information on large asset trades and prices by selecting the appropriate network.

Trading on Zapper

You can use Zapper platforms to trade various assets. It is a kind of decentralised aggregator of finding the most profitable quotes among different exchanges. There are differences in the work of Zapper from similar aggregators, for example, from 1inch. Unlike other projects, Zapper acts as an aggregation layer between platforms and users. On the portal, it is possible to view trading activity in the chains that the protocol supports. Information on Zapper will be presented for the specifically selected asset.

Zapper transactions do not incur protocol fees and users only need to pay the trading platform’s fees for quotes.

In addition to token and coin data, users can also get information on Ethereum, Airbitrum, Optimism and Base-based NFTs on the portal. Zapper provides a selection of information about the best and most profitable NFTs. Users can also specify the asset they are interested in. Among the data that Zapper reveals are current value, liquidity, total supply, ranking, number of transactions, trading volume, price change graph and a list of recent trades. An option to provide information on the most profitable and failed transactions is in development.

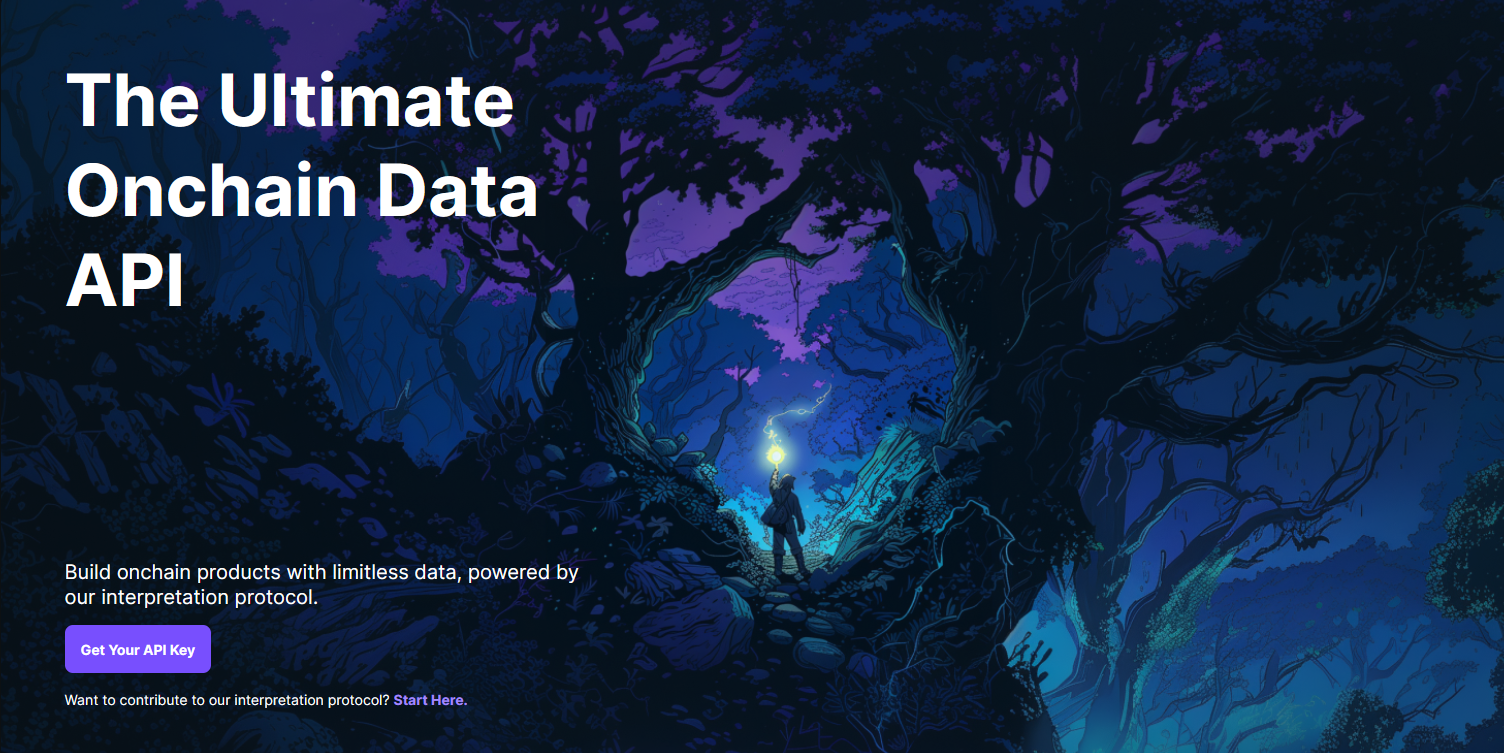

Among the novelties of the protocol is the emergence of a single API to access all DeFi positions, tokens, applications, NFT collections and human-readable transaction channels across more than 40 chains. To access detailed information, all you need to do is take the open source code and make small changes to integrate Zapper onto your platform. Once integrated, customers get a display of the balance of tokens stored at a specific address, real-time balance updates, coverage of each token and asset metadata, including detailed pricing information.

How Zapper simplifies cryptocurrency investments

Zapper is a popular DeFi aggregator that specialises in working with Balancer, Curve, and Uniswap liquidity pools. With its help, you can switch between them and allocate capital to different pools in one click. The project supports more than 50 DeFi protocols that work on Ethereum, Polygon, Airbitrum and a number of other networks.

Asset holders who make money from placing funds in liquidity pools are familiar with spending time searching for suitable investment options. With Zapper this problem will not arise, as the platform analyses all offers on the market and provides the user with a list of the most profitable ones.

The big plus of the protocol is that it allows combining several transactions into one, which reduces the time for transactions and also saves money on commissions. For example, if an investor decided to choose the ETH-USDC liquidity pool, he has to provide a certain share in each of the pools, in Uniswap the share is 50/50. With this in mind, the user would be faced with having to exchange their ETH to USDC and only then transfer it to the liquidity pool. Zapper utilises the Zaps smart contract, which automatically performs the exchange. In one transaction, the investor becomes a member of the liquidity pool.

Profit and loss ranking system in Zapper

In January 2024, the project revealed further development plans, including the development of a new tool aimed at improving investor interaction with digital assets. Zapper is launching a profit and loss ranking service. This innovative feature is designed to serve both tokens and non-fungible tokens (NFTs), offering a dynamic and comprehensive overview of the top 100 winners and losers in the market.

This tool aims to find the most profitable assets to invest in. In the multifaceted world of cryptocurrencies, it is very difficult to keep track of all the novelties, so Zapper entrusted this to a universal algorithm that takes into account dozens of parameters.

On the platform, investors can get a convenient interface for tracking the state of their portfolio. Zapper takes into account a client’s assets across platforms in real time, giving full access to information.

Zapper’s new ranking system is more than just a tool; it’s a gateway to making informed digital asset decisions. And data is available not only on tokens, but also NFTs. The ranking system will support protocols from several networks including Ethereum, Base, and Airbitrum, giving a broad user base.

ZAP token

In the summer of 2024, the Zapper Crypto project announced not only the launch of a new product API, but also plans to release its own ZAP token. It will be used to pay rewards in the updated protocol.

In the future, Zapper intends to provide more information on how developers can use human-readable data in their applications through a new open GraphQL API. The interpreted protocol dataset will facilitate the development of advanced social features.

The interpretation aspect of the Zapper protocol will allow anyone to contribute and help Zapper make blockchains more readable. In addition, the protocol introduces indexing templates that open up the interpretation layer, allowing users to add new integration to DeFi the protocol or to represent human-readable transactions. This process does not require coding knowledge. At launch, there will be two types of interpreters: position interpreters and event interpreters; more types are planned to be implemented in the future.

As part of the updated protocol, users can be rewarded for performing two basic functions. One is being able to mediate inter-network transfers. This allows users to earn money from the commission that clients pay for transactions.

Since Zapper for Solana and other protocols acts as an information service, in order for users to get the most reliable information possible, they need partners to provide transaction data. There is a reward for this in the form of a payment of ZAP’s own token.

The GraphQL (API) was launched in the fourth quarter of 2024. In 2025 and 2026, the protocol is expected to decentralise and new interpretation primitives are expected to be introduced.

All Zapper features

Users have access to the following functionality:

- Dashboard. This is a single interface for all transactions by users for all connected wallets. It is possible to check the statistics of transfers for the selected wallet.

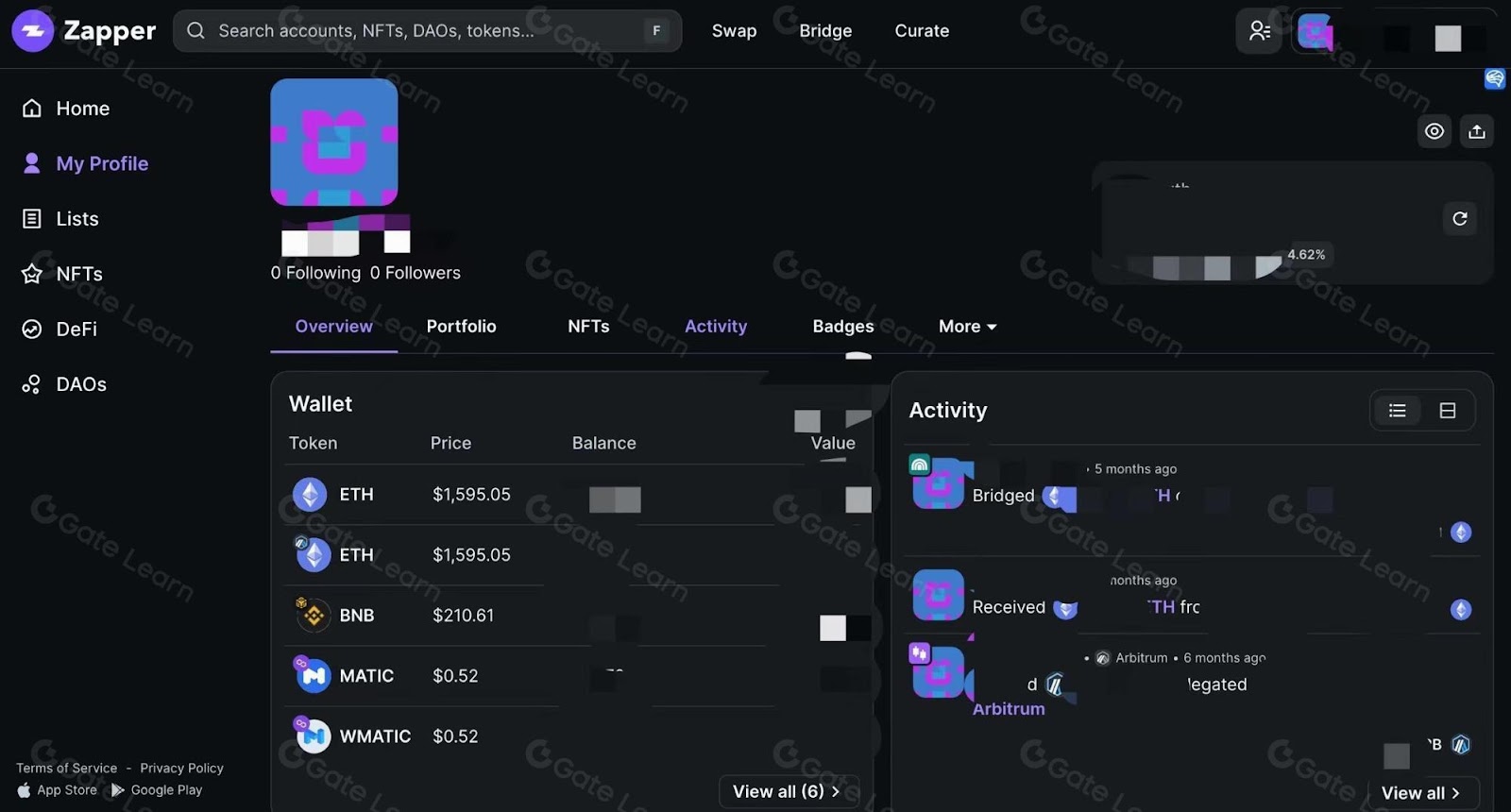

- Exchange. A system for exchanging tokens from one network to another. Zapper supports more than 1000 different coins.

- Liquidity pools. Directly through Zapper the user can provide his funds to the selected liquidity pool. Note that the transfer can be made in one transaction, the conversion of the asset to the second pool token will happen automatically.

- Farming. Zapper customers can participate in revenue farming.

- Deposits. A Zapper user can make a deposit, deposit it into a credit protocol and earn interest on it.

The project is actively developing, so in the future it is possible that new functionalities will appear or existing ones will be improved.

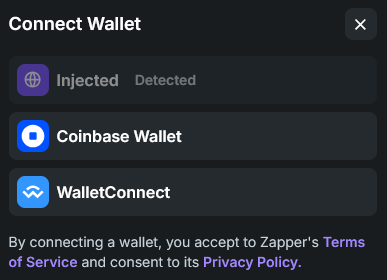

Registration in Zapper

The portal does not require registration, but to have access to all the features of the service will require adding your cryptocurrency wallet. The portal supports a large number of wallets that can be added. There are over 50 listed, including Zerion, Core, Okto, Marble, Paper, Vently, NuFi, and more.

To get full access to the functionality of Zapper you need to go to the portal’s website and click on the ‘Connect Wallet’ button. Then choose a suitable one from the list and complete the setup, adhering to the algorithm provided by the protocol.

Features of the Zapper portal

The main features of the crypto project Zapper:

- Non-custodial;

- Centralised;

- Monitoring of the entire crypto portfolio from a single interface;

- Risk management for signing smart contracts and transactions;

- NFT support;

- Notifications;

- Investment recommendations;

- Available on iOS and web version;

- Over 190,000 users.

The portal plans to switch to a decentralised format of operation.

Who Zapper is suitable for

Zapper is a great assistant for those who do not plan to invest exclusively in one DeFi project. If you are constantly looking for favourable offers to invest in cryptocurrency protocols, you should have access to reliable information that is displayed in real time. Zapper provides such an opportunity.

You can also use the portal as a tool to control your own assets. After adding a cryptocurrency wallet, you will be able to track all transactions and get access to the archive of transactions. This will allow you to track how effectively you manage your assets. The portal also allows you to track your financial obligations, such as a list of upcoming mandatory payments.

Additionally, Zapper provides token exchange and asset transfer services between different networks. These services are secondary to the project, so they have received less attention.

Pros and cons

Pros

- simple and intuitive interface, which makes it possible to work with protocols without much experience;

- the ability to see information on crypto assets in one place;

- the presence of educational articles that allow beginners to learn how to work with the protocol and immerse themselves in the world of cryptocurrencies;

- Zapper regularly works to improve the protocol and improve information on assessing the attractiveness of crypto assets.

Cons

- the need to connect a cryptocurrency wallet, which can be a problem for those who are just getting acquainted with the decentralised application industry;

- lack of comprehensive customer support, the availability of educational materials does not cover all the questions a user may have;

- due to the abundance of information when evaluating cryptoassets, newcomers may not understand many points in an overview of a protocol, token, liquidity pool or NFT;

- inability to cancel a transaction if you have confirmed it in your crypto wallet, this is a common problem for all DeFi projects, not just Zapper.

Conclusion

Zapper is a universal platform that combines in a single interface control over personal finances, getting information about DeFi projects, the ability to trade through aggregators, buying and selling NFTs. Also on Zapper you can get detailed information about each token, NFT and protocol. Taking into account the received information about trading volume, rate dynamics, liquidity and recent transactions, one can make a decision to sell or buy assets.

The project is constantly evolving. In 2024, the team issued its own token and integrated the possibility of earning on it by providing information services or acting as an intermediary in transactions. The project is actively developing, and its team actively supports in social networks its users, it makes sense to use Zapper as the main tool for interaction with DeFi projects.

Answers to Frequently Asked Questions

What are DeFi aggregators?

Zapper belongs to the category of DeFi-aggregators projects. They are platforms that show the user’s balance and transactions of DeFi protocols in one interface and allow transactions in them. They help the user to manage their investment portfolio, which includes tokens from different DeFi protocols, in real time.

Benefits of running Zapper?

The platform has many pluses, but two main ones can be highlighted for users. Firstly, Zapper allows you to save money on commission fees. If a client plans to invest in liquidity pools, it will be enough to make one transfer rather than exchanging tokens for a second liquidity pair. This means that the client pays the commission only once and immediately becomes a member of the liquidity pool. Secondly, a detailed interface for choosing the best conditions for investment. Top tokens and NFTs can be found on the project, each of them has information about trades, price dynamics, 100 best and worst trades and other useful information that simplifies the choice of assets for investment and earning on cryptocurrency.

What are the main functions of Zapper?

The protocol provides several tasks. Users can use Zapper to track assets in their investment portfolio, study the list of the most profitable tokens to invest in, exchange tokens in different networks, contribute funds to liquidity pools and customise the interface to take into account the most important data in the evaluation of crypto assets.